It’s been an exciting two months for CoinFi! Today, we’re looking to provide you an update on our most exciting release yet as well as the first use case for our token – CoinFi Trading Signals.

For those of you who have been a tad bit out of the loop, we started working on ingesting the blockchain data back in Q2 2018.

In August, we helped Google with ingesting the Ethereum blockchain so that the data would become available in BigQuery. Specifically, our Data Engineer Evgeny built the system and infrastructure necessary to read all the data from the blockchain, structuring it and storing it into Google BigQuery.

At the same time, we started working on trading signals that would give users a competitive edge in trading. We knew that certain blockchain transactions from notable wallets such as insiders, whales, and exchanges were extremely valuable, and if users had access to this information, they would have a true competitive edge by leveraging our data. Thus, blockchain, data driven trading signals became our priority focus for Q4.

Fast forward to this month, we’ve opened sign ups to small batches of users as we worked on iterating our sign up page to improve conversion rates. Today, we would like to officially announce the public beta launch of CoinFi Trading Signals!

So What is CoinFi Trading Signals?

CoinFi Trading Signals is our current flagship product designed to give you an edge in trading. Our back-tested trading signals will alert you on buying and selling opportunities utilizing blockchain data to detect exchange movements and insider trading.

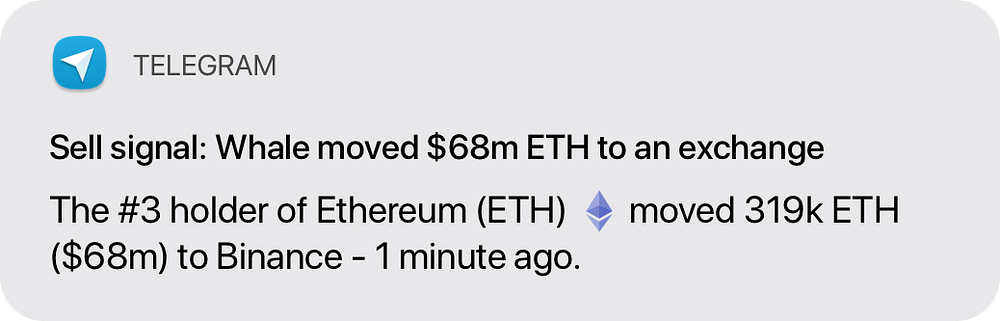

We’ll constantly be adding new signals as our data science team and professional traders work together in figuring out what signals actually work. For now, our signals will be communicated via Telegram bot, but we will look into exploring additional ways to communicate our signals in the future.

Accessing the beta will require you to stake 25,000 COFI tokens for three months.

Example Case Study

At this point, some of you may be wondering whether the signals actually work.

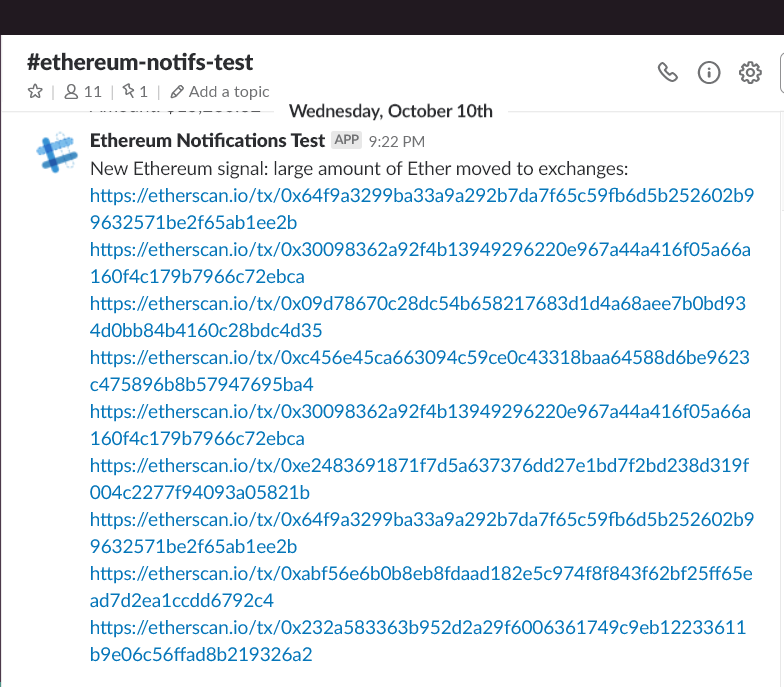

We’ve been testing multiple signals through our alpha model on Slack. Below is an example of an alert telling us large amounts of ETH movement going into exchanges:

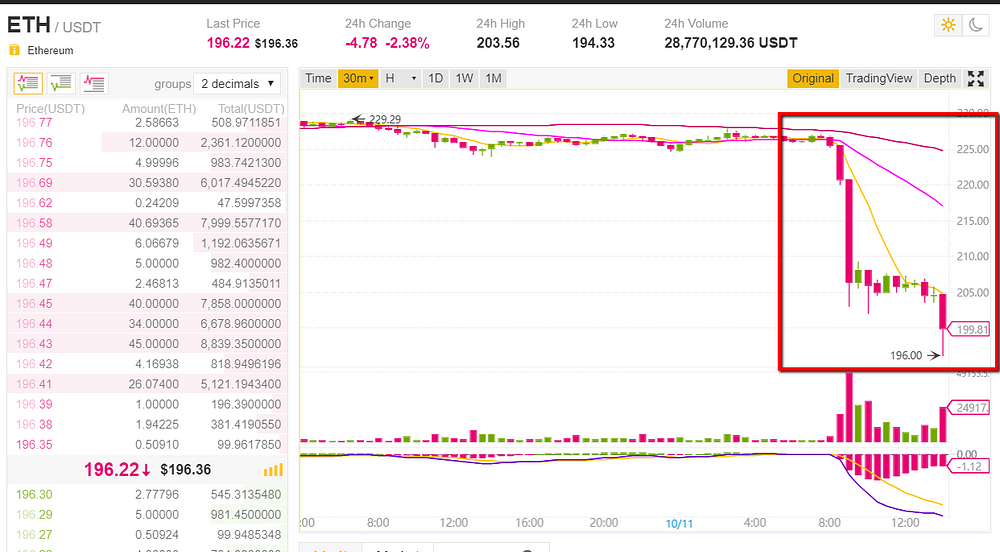

Not surprisingly, given the large amounts of ETH going into exchanges, if we took a look at the price movement of ETH/USDT on Binance roughly 10 hours later, we would’ve seen this begin to unfold:

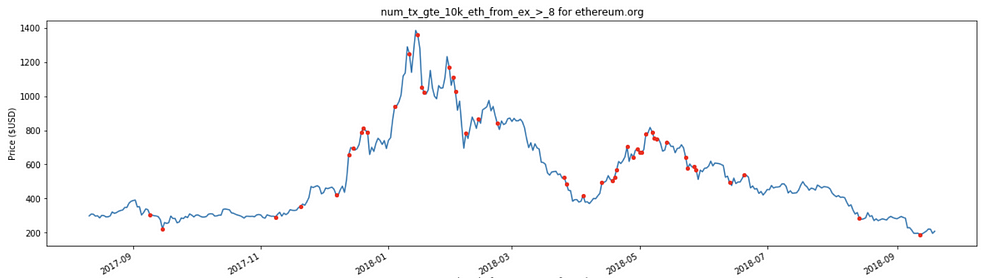

Of course, no signals work 100% of the time, and this is true even for our data driven trading signals. However, we did find that historically, this particular signal has a 67% accuracy rate in predicting downwards price movement within the next 24 hours:

The chart above is the result from our back-testing of the ‘movement of ETH into exchanges’ signal. The red dots plotted on the graph represent the price point at which our signals had alerted us to sell. 67% of these red dots had accurately predicted a downward price movement within 24 hours.

Limited Access

Let’s be honest. If we released this signal to everyone, the signals aren’t going to work because everyone would have an edge, which really just means nobody gets an edge. In an efficient world where everyone has access to our signals and know it works, the price movement would be captured as soon as our signals get released, and aside from the few quick hands out there, nobody else would be able to capitalize on it.

That’s why we’ve capped the number of spots at 2,000 users, first come first serve. Reserve your spot now.

Note: We’ve set measures in place to ensure our signals aren’t being shared outside of our Telegram bot. There will be a unique identifier that makes the signals we send to each user different from one another. Any malicious user caught by our system will have their staked tokens confiscated and redistributed to the remaining staked users.