NFT Collection The Superlative Secret Society Price, Stats, and Review

Coinbase CEO Predicts $1M Bitcoin Driven by FOMO, ETFs, Government Action

Best Crypto to Buy Right Now — MAGACOIN Finance Forecasted 35x ROI vs Avalanche & Polygon

BlockDAG Closes in on $600M as Excitement Builds: Should You Get In Now?

ETH leads, BTC steady, LINK hits $27 on September Fed rate cut optimism

Left On The Sidelines With Brett? MoonBull Whitelist Is Closing Fast; Grab Your Second Shot At The Best Upcoming Crypto For 2025

XRP vs. XLM: Difference, Adoption and Long-Term Growth

Ethena set for 6% correction – Why do whales keep buying?

Bitcoin and Ethereum ETF Outflows: Where Is The Money Going? Is Layer Brett’s Presale The Reason?

Top 5 Biggest Crypto Losers Today as Market Cap Slips Below $4 Trillion

Best Crypto to Buy in 2025: Ripple (XRP) and Moonshot MAGAX Dominate Altcoin Picks

Joint Toyota-Avalanche White Paper Proposes Cross-Border Mobility Protocol

Frustrated Cardano and XRP Traders Pile Into Ethereum L2 Gem Layer Brett

Hacker Moves Loot: Over 38,000 Solana Purchased With Stolen Crypto

How stablecoin inflows are shaping the L1 price race

BlockDAG’s $381M Presale Success Wasn’t Luck, Meet The Core Team Made It Happen!

Top 10 Crypto PR Agencies [2025 Ranking with Case Studies]

Best Altcoins to Watch for Big Gains in September

Heaven Challenges Pump.fun as Solana’s Hottest New Launchpad – $350M Volume Already

XRP Price Prediction: Which Of These PayFi Altcoins Will Hit $5 First? Remittix Or Ripple

Bitcoin Flash Dumps Below $111K After Ether Hit Record Highs

MAGACOIN FINANCE Presale Nears Final Stage — Early Investors Eye Strategic 35x ROI Entry

Michael Saylor Hints Fresh Bitcoin Purchases as All-Time Profits Near $26B

Decoding Hyperliquid’s slowdown: Why Bitcoin’s next move can define HYPE

Shiba Inu Price Drops Over 7% In The Last Year As Investors Looking For Higher Gains Snap Up Remittix

Buy Or Sell Arbitrum (ARB)? Here’s What Whales Are Doing

The Arbitrum airdrop has been one of the most highly anticipated events in the crypto space in recent weeks, but the price performance of the ARB token is rather disappointing at the moment. Facing a massive selling pressure from the beneficiaries of the airdrop, the Arbitrum token dropped to a low of $1.11 on Monday.

Since then, however, ARB has been in an uptrend, maneuvering the price up to $1.44 yesterday. With this, ARB gained 23% since the beginning of the week. At the moment, however, there is a correction that caused the price to drop. But, where do we go from here?

Are Wale And Institutions Buying Or Selling ARB?

On-chain analysis service provider Lookonchain has analyzed the largest Arbitrum whales to find out what the “smart money” is doing. In doing so, the analysis service found that Amber Group, a leading digital asset company, has reduced most of its ARB holdings.

Two related addresses of Amber transferred 11.2 million ARB worth $15.8 million, of which 7.3 million ARB (about $10.3 million) were transferred to crypto exchanges OKX and Binance. The remaining 4.47 million ARB worth $6.3 million continue to be held by the Amber related address.

However, other whales are accumulating the ARB token. In total, Lookonchain has found three major holders adding to their holdings. Whale “0xe04d” received 2.186 million ARB (about $3.08 million) from OKX the day before yesterday, and bought another 1.861 million ARB (about $2.62M) from OKX and Binance yesterday.

Another whale currently holds 4,048 million ARB (around $5.71M). Whale “0xadf5” received 2.288 million ARB (around $3.22M) from OKX a day ago, and added another 1.81 million ARB (around $2.55 million) a little later. Currently, he holds 4.099 million ARB (about $5.78M).

In addition, the largest buyer continues to hold ARB and has not transferred any of his Arbitrum tokens. This unknown whale still holds 9.94 million ARB (about $14 million). He had increased his holdings by 5 million ARB on the first day of the listing on major exchanges.

Arbitrum Fundamentals Remain Strong

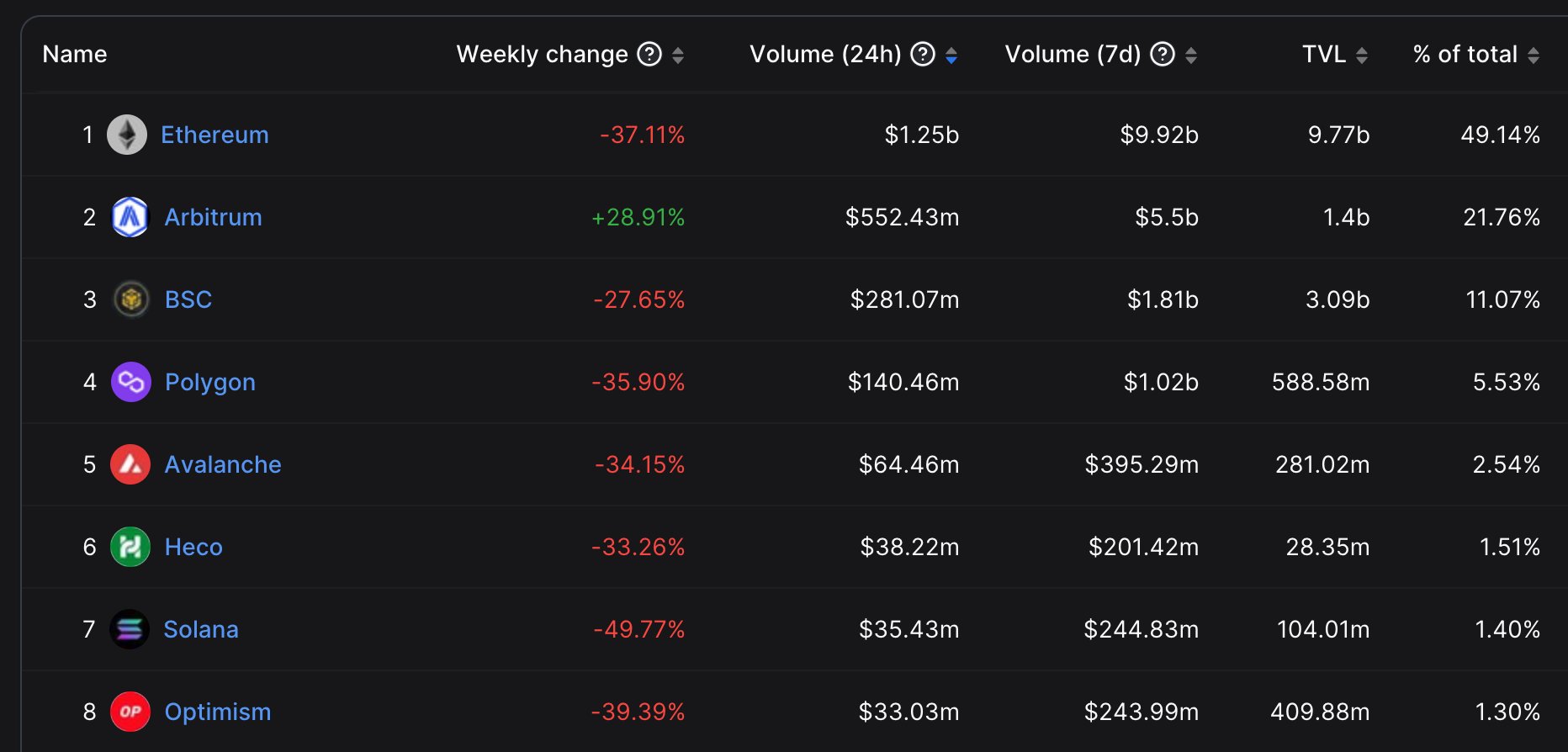

As analyst Aylo outlined in a Twitter thread, Ethereum’s layer-2 technology shows no signs of slowing down after the airdrop. Arbitrum has done more DEX volume in the last 24 hours than BSC, Polygon, and Avalanche combined, as the chart below shows.

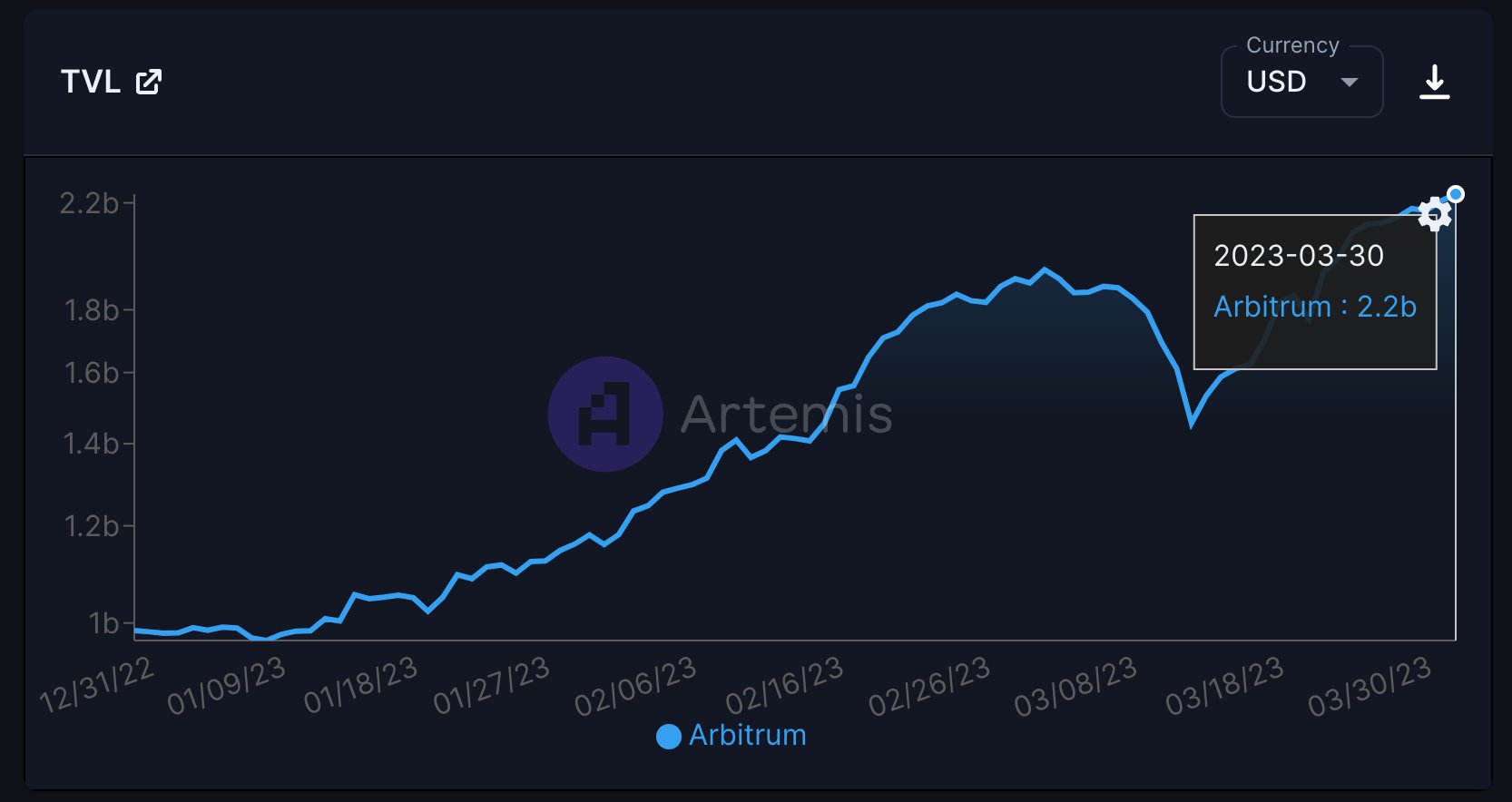

Also bullish are daily transactions and daily active addresses, which remain higher than a month ago. Likewise, TVL shows consistent growth and continues to climb higher. TVL reached a new high of $2.2 billion yesterday, up from around $1.5 billion in the middle of the month.

In addition, Arbitrum is seeing the largest percentage increase in stablecoins bridged in the last 7 days. Daily revenue is also steadily increasing.

ARB Price Today

At the time of writing, ARB was at $1.35. Since Monday’s low, ARB’s 1-hour chart shows a clean uptrend that is still intact despite the consolidation. ARB continues to post higher highs and higher lows.

Currently, the most important support is the $1.32 level. If ARB falls below this price, the uptrend could falter. For now, however, the bulls retain the upper hand.