NFT Collection The Superlative Secret Society Price, Stats, and Review

Gold, Silver, Bitcoin: Why Robert Kiyosaki Believes Paper Isn’t Enough

TRON H1 2025: Consistent Growth Across Key Fundamental Metrics

JPMorgan Chase Highlights Sector That’s Primed To Outperform US Equities Over the Next 10–15 Years, Outlines Diversification Strategy

XRP issuer Ripple sees its RLUSD stablecoin grow among retail users

This Next-Gen Layer-1 Goes Live in September—What You Should Know

Is Polymarket legit or not in 2025?

Asia’s OSL Group raises $300M for stablecoin and global expansion

Robert Kiyosaki Warns Crypto ETF Investors, Urges to Hold Real Bitcoin

Bitcoin Dips on Whale Cashout

Crypto Expo Europe 2026: Eastern Europe’s flagship web3 event returns to Bucharest

BioSig Technologies and Streamex: Pioneering Real-World Asset Tokenization in the U.S. Market

Traders just added 10,000 Bitcoin worth of open interest to BTCUSDT, here’s what could happen

MDT up over 170% in the last 24 hours, will the rally continue?

Eric Trump Says Ethereum Is Undervalued

EU BTC treasuries pile up as Refine Group raises $475k to buy Bitcoin

Bitcoin Pullback Remains Within Normal Volatility Range: Drawdown Analysis Shows No Signs Of Panic

Bitcoin Whiplash: BTC Dives Below $115K, $140M in Longs Liquidated

XRP News: Analysts Favor Unilabs Finance (UNIL) Over XRP as Bull Run Leader, Its Utility token is predicted for over 50x Returns.

Bitcoin Rally Isn’t Over Yet, Analysts Say – $138K Could Be Next Target

Bitcoin-focused The Smarter Web Company inches closer to 2,000 BTC with latest purchase

Kraken to integrate INK token and L2 to power onchain expansion

Bitcoin Cash up 7% as bulls defy BTC dump, eye gains on rising volume

XRP & BTC Holders Tap Into $9,999 Daily Earnings as GENIUS Act Spurs Crypto Boom

New “Ethereum Killer” SUI Launches Today, What You Need To Know

Today is the day, the long-awaited launch of the next “Ethereum killer” SUI is taking place at 8:15 am EST (12:15 UTC). From a purely technical standpoint, SUI does a few things differently compared to Ethereum, and therefore the expectations are high. In addition to the bankrupt exchange FTX, the project has numerous notable backers, including Circle, Binance Labs, and Electric Capital.

The designated proof-of-stake (dPoS) blockchain has an entirely new architecture that is supposed to outshine even the “high-speed” blockchain Solana. Many of Sui’s developers previously worked on the Meta (Facebook)-launched project Diem, which was scrapped some time ago due to regulatory headwinds.

The developers behind Sui, Mysten Labs, are one of two spinoffs from Diem, the second being none other than Aptos, which celebrated its mainnet launch last October. The former Meta employees founded Mysten Labs back in 2021 to develop Sui.

Why Sui Is Being Hyped

One of the things that sets the Sui blockchain apart is its tremendous processing speed of data, which no other layer-1 blockchain can match. In testing, Sui already brought it to more than 300,000 transactions per second (tps). This far exceeds even Solana (65,000 TPS). Likewise, Sui has a big speed advantage in transaction confirmation time.

While Solana needs around 20 seconds, Sui’s is only 450 milliseconds. In terms of scalability, Mysten Labs says that the system design is designed to allow horizontal scalability, which is not capped.

In addition to Sui’s high throughput and low latency, the project also touts a third advantage: the ability to process arbitrary amounts of data on chain. To do this, SUI makes use of a storage fund that redistributes fees for past transactions to future validators.

In other words, users pay upfront fees for both computation and storage. When storage requirements on-chain are high, validators receive additional rewards to offset their costs. Conversely, when storage requirements are low.

These three benefits are meant to take the use cases of blockchain technology to the next level.

Tokenomics

While IOUs were already trading on smaller exchanges ahead of the official launch of the blockchain at 8 am EST (2 pm CET), well-known crypto exchanges such as Binance, OKX, KuCoin, and ByBit have announced the listing of the new token as soon as liquidity requirements are met.

Binance, for example, said it expected to begin trading SUI/BTC, SUI/USDT, SUI/TUSD and SUI/BNB at 8:15 am EST.

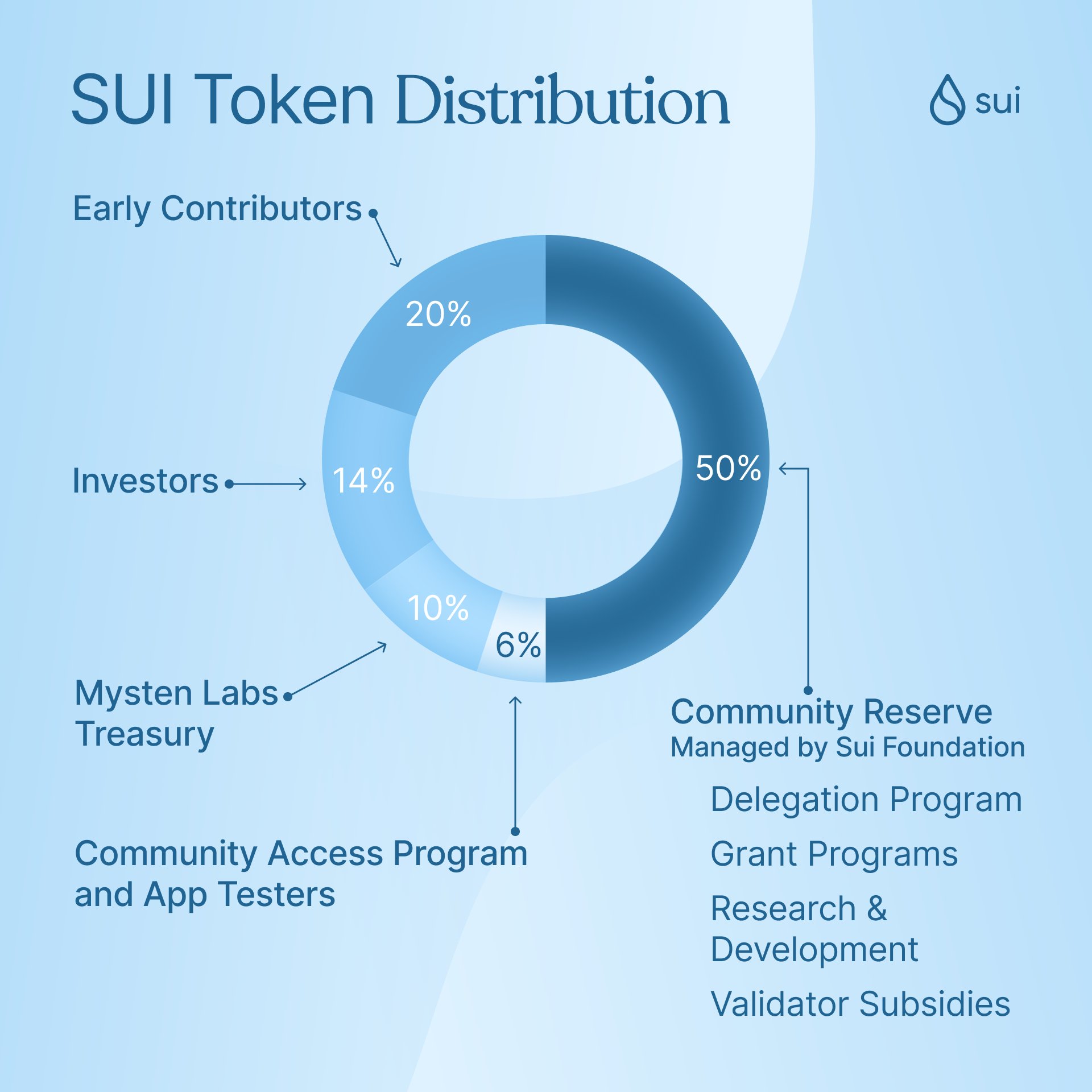

SUI’s token supply has a cap of 10 billion tokens. As stated by the Sui Foundation, a portion of the total supply is expected to be liquid when the mainnet launches today. The remaining tokens will be transferred or distributed as future reward grants for shares in the coming years.

In the Sui economy, the token has four purposes. It can be used to participate in the proof-of-stake mechanism. It is the asset required to pay gas fees to conduct transactions and other operations.

Furthermore, the token is an asset that supports the entire economy with its value. Ultimately, the token plays an important role in governance as it serves as the right to participate in voting on-chain.