NFT Collection The Superlative Secret Society Price, Stats, and Review

Bitcoin Poised for Major Move as Monthly Range Narrows, Analyst Says

Aptos Breaks $5 & PEPE Coin Holds Steady, While BlockDAG Nears $300M at $0.0276 in Batch 29

XRP Has A 70% Shot To Beat Bitcoin, Says Analyst

$750 Million Bitcoin War Chest: Pompliano Prepping Mega Crypto Fund

Top 3 Reasons Solana Price May Rebound 20% After This Crash

XRP Falls to $2.24, ADA Risks $0.60 as BlockDAG’s US Deal Teases 2025 Breakout

Aptos blockchain development booms, but APT dips 8% – Is THIS why?

Tony G Co-Investment Buys 10,000 Hyperliquid Tokens to Strengthen DeFi Strategy

Ripple Resumes RLUSD Minting with 12 Million Ahead of GENIUS Act Vote

Fidelity Files for Solana Spot ETF

California Doctor on the Run After Being Sentenced to Prison for Medicare Fraud

XRP Bullish Structure Remains Bullish: Analyst Releases 3 New Targets

BlockDAG’s Current Batch 29 Won’t Last Long: Here’s Why Experts Say This Is the Top Crypto to Buy Now!

Bitcoin drops to $104K: Can $3.3B in inflows spark BTC’s reversal?

Shiba Inu Goes Serious: Shib Alpha Layer Marks End Of Meme Era

These 4 Altcoins Are Poised To Rise Even If the Broader Market Stalls

ETH price trend data suggests all future dips are for buying

Sharplink Gaming Becomes Largest Public ETH Holder With $463 Million Purchase

Bitcoin to $1M? Galaxy’s Novogratz says adoption wave could trigger 10x rally

Ethereum Bullish Bets Rise: ETH’s Cash-Margined Open Interest Skyrockets To New Levels

Crypto Expert Explains Why $27 XRP Might Not Be Just a Dream

Ethereum Price Prediction: ETH Just Snapped Its Sideways Streak, Here’s Why $3,000 May Be Just the Beginning

Bitcoin price breakout to $119K possible if oil rally pattern holds

Ethereum Faces Inflationary Pressure: Has the Ultra Sound Money Era Ended?

Ethereum (ETH) which is addressed as ultra-sound money due to its deflationary supply method, now appears to be facing new challenges that have prompted some analysts to question whether this narrative still holds.

A prominent crypto analyst, Thor Hartvigsen, recently highlighted this issue in a detailed post on X, where he discussed the current state of Ethereum’s fee generation and supply dynamics.

Is ETH No longer Ultra-Sound money?

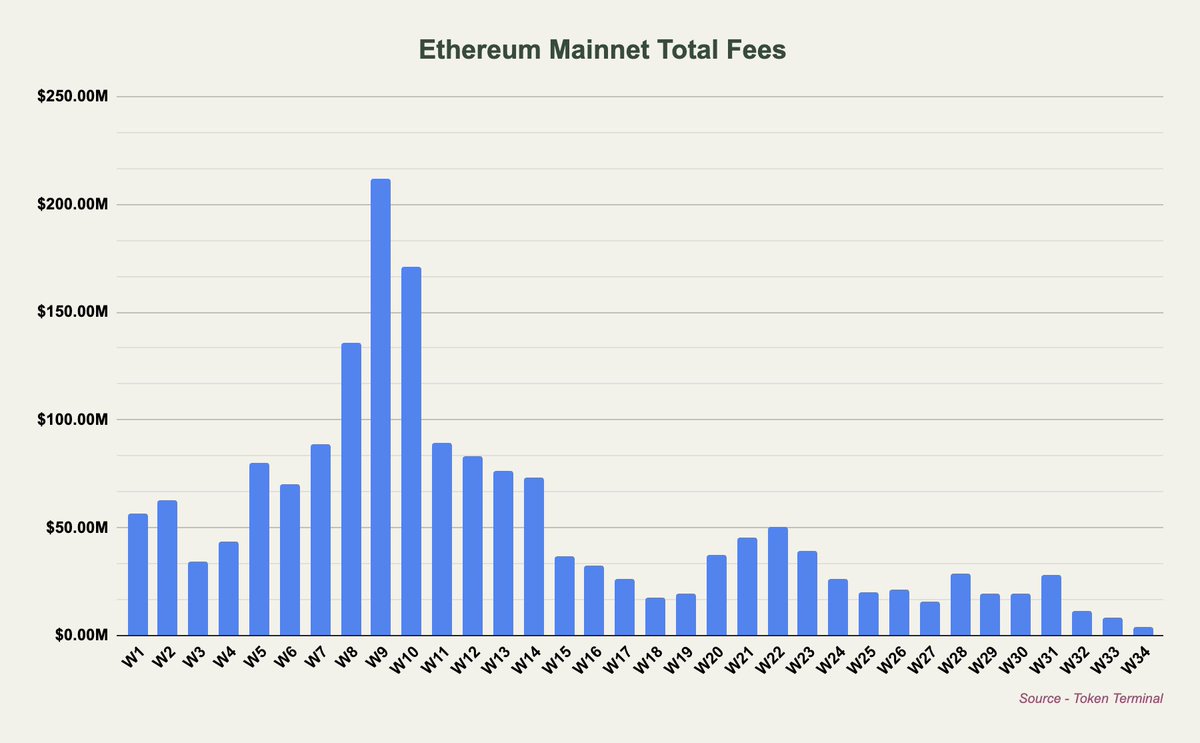

Hartvigsen pointed out that August 2024 is “on track to be the worst month in terms of fees generated on the Ethereum mainnet since early 2020.” This decline is largely attributed to the introduction of blobs in March, which allowed Layer 2 (L2) solutions to bypass paying significant fees to Ethereum and ETH holders.

As a result, much of the activity has shifted from the mainnet to these layer two (L2) solutions, with most of the value being captured at the execution layer by the L2s themselves.

Consequently, Ethereum has become net inflationary, with an annual inflation rate of approximately 0.7%, meaning that the issuance of new ETH currently outweighs the amount being burned through transaction fees.

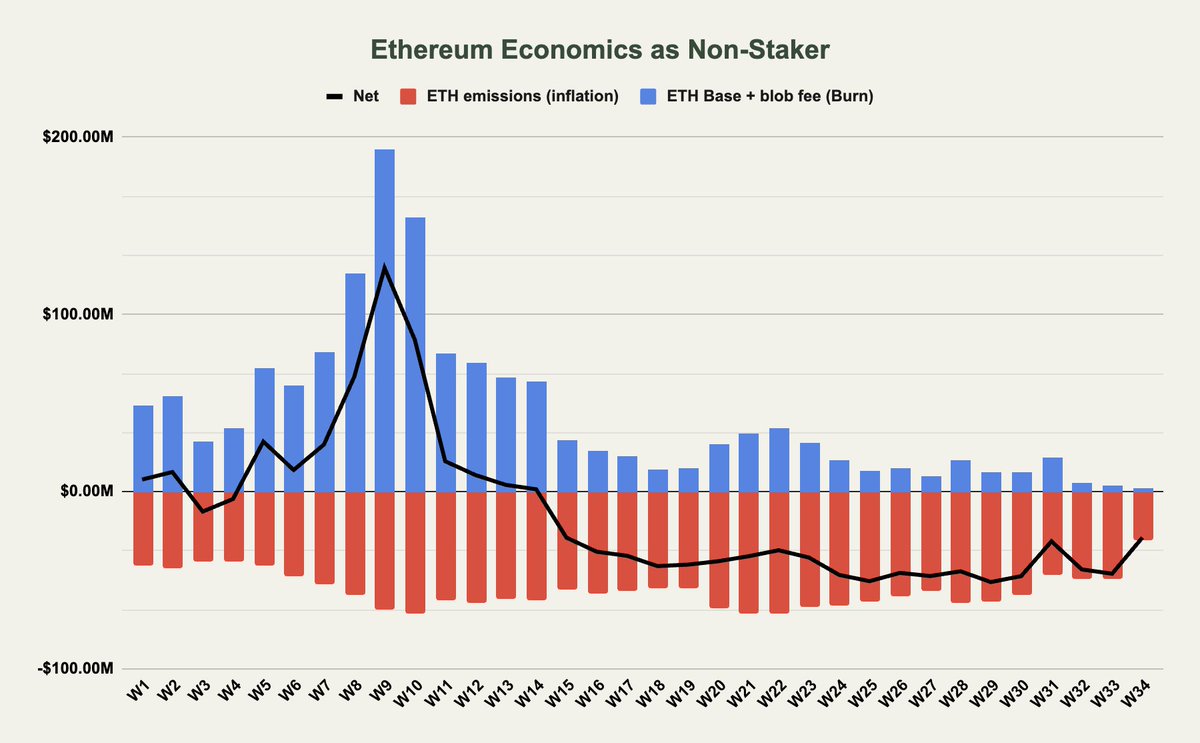

Hartvigsen disclosed the impact of this on Non-Stakers and Stakers: According to the analyst, non-stakers primarily benefit from Ethereum’s burn mechanism, where base fees and blob fees are burned, reducing the overall supply of ETH.

However, with blob fees often at $0 and the base fee generation decreasing, non-stakers are seeing less benefit from these burns. At the same time, priority fees and Miner Extractable Value (MEV), which are not burned but rather distributed to validators and stakers, do not benefit non-stakers directly.

Additionally, the ETH emissions that flow to validators/stakers have an inflationary effect on the supply, which negatively impacts non-stakers. As a result, the net flow for non-stakers has turned inflationary, especially after the introduction of blobs.

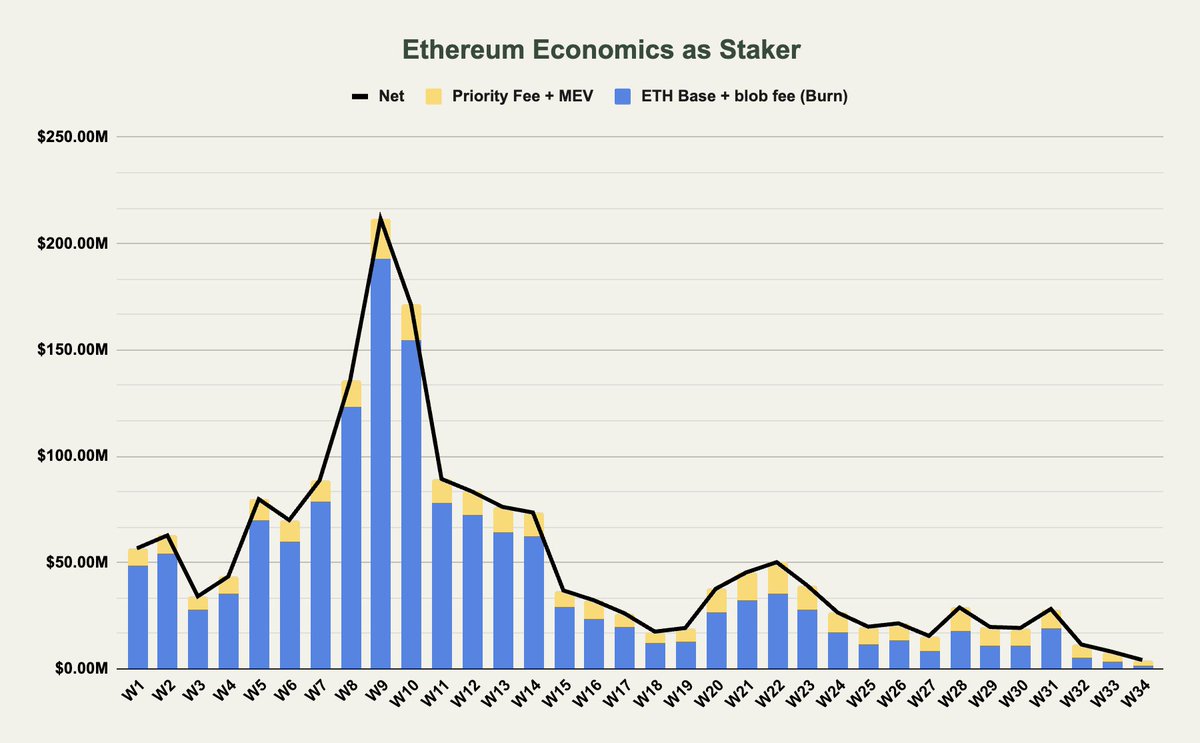

For stakers, the situation is somewhat different. Hartvigsen revealed that stakers capture all the fees, either through the burn or via staking yield, meaning that the net impact of ETH emissions is neutralized for them.

However, despite this advantage, stakers have also seen a significant drop in the fees flowing to them, down by more than 90% since earlier this year.

This decline raises questions about the sustainability of the ultra-sound money narrative for Ethereum. To answer that, Hartvigsen sated

Ethereum no longer carries the ultra sound money narrative which is probably for the better.

What’s Next For Ethereum?

So far, it is quite evident with the current trends that Ethereum’s ultra-sound money narrative may no longer be as compelling as it once was.

With fees decreasing and inflation slightly outpacing the burn, Ethereum is now more comparable to other Layer 1 (L1) blockchains like Solana and Avalanche, which also face similar inflationary pressures, says Hartvigsen.

Hartvigsen notes that while Ethereum’s current net inflation rate of 0.7% per year is still significantly lower than other L1s, the decreasing profitability of infrastructure layers like Ethereum may necessitate a new approach to maintaining the network’s value proposition.

One potential solution the analyst discussed is increasing the fees that L2s pay to Ethereum, though this could pose competitive challenges. Concluding the post, Hartvigsen noted:

Zooming out, infra-layers are in general unprofitable (study Celestia generating ~$100 in daily revenue), especially if viewing inflation as a cost. Ethereum is no longer an outlier with a net deflationary supply and, like other infra-layers, require another way to be valued.

Featured image created with DALL-E, Chart from TradingView